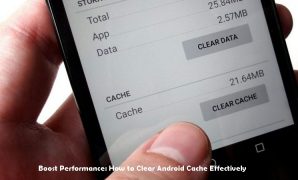

Over time, Android devices accumulate cache files that can slow down performance. These temporary files help apps load faster, but Read more

New Life in Technology

How to Optimize Android Battery to Make It Longer Lasting

To optimize the Android battery, there are several ways that can be done. Optimizing the battery is indeed quite important Read more

Practical Steps to Remove Annoying Ads on Android Phones

Sometimes, ads that suddenly appear on Android phones make everyone overwhelmed. Moreover, when you need a cellphone for important activities. Read more

Android Phone Not Receiving Calls, Check the Solution Here

Android phone not receiving calls certainly makes its users feel confused. Especially if you are waiting for an important call, Read more

A Complete Guide to Troubleshooting Android Wi-Fi Connection Issues

A stable Android Wi-Fi connection is essential for uninterrupted internet access on our Android devices. From browsing the web to Read more

Boost Android Speed: Simple Tips for a Faster Device

In today’s fast-paced digital world, a slow Android device can disrupt productivity and cause frustration. Over time, even high-end smartphones Read more

Android USB Port Not Working: How to Diagnose and Fix

The Android USB port not working will be very annoying. This USB port functions to charge Android phones. When it Read more

Fix GPS Issues on Your Android Phone: Get Back on Track

The Global Positioning System (GPS) has become an indispensable tool, facilitating various activities such as sharing locations, tracking runs, and Read more

Android Back Button Not Working: Regain Control

Solving the Android back button not working on screen is very easy. An Android back button that does not work Read more

No Ringtone Sound on Android? Restore Your Phone’s Alerts

An Android no ringtone sound is a common problem for Android owners. Ringtones serve as notifications. Today, Android has become Read more